Travel Insurance in Asia: Coverage for China, Thailand, Bali, Japan, Malaysia, Vietnam, and the Philippines.

Trusted by 100,000+ Travelers

Evacuation & Repatriation

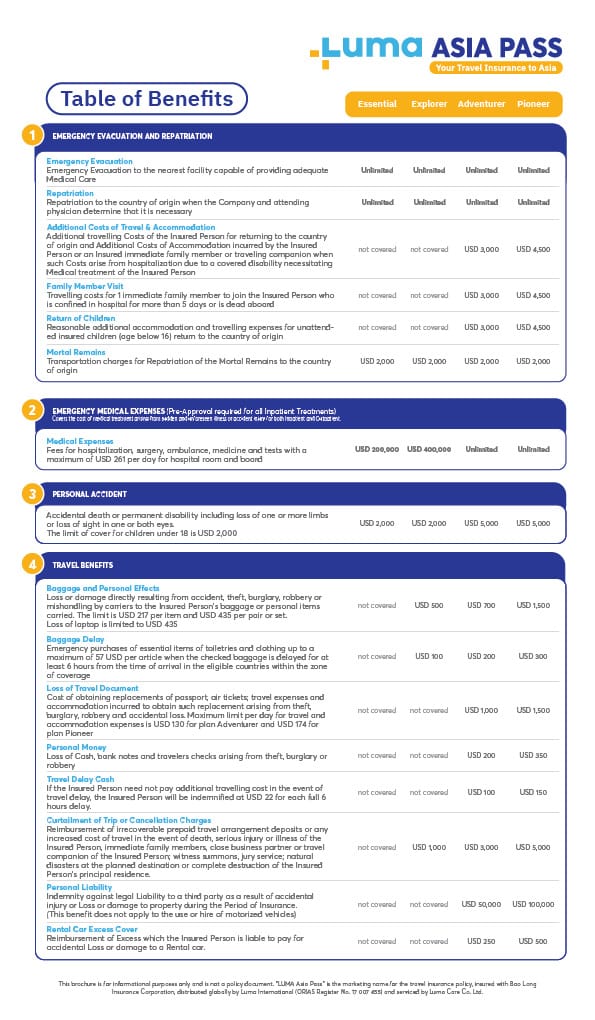

Highest Coverage for Medical Expenses, Emergency Evacuation and Repatriation.

Serviced by LUMA international teams.

Coverage benefits designed to protect you in Asia.

200,000 USD to UNLIMITED Coverage

UNLIMITED Coverage

UNLIMITED Coverage

Covered Up to 5,000 USD

Covered Up to 5,000 USD

Covered Up to 1,500 USD

A multilingual emergency hotline is available every day, around the clock, to assist with your urgent situations.

Dr. Gerard

Emergency Medicine, Aviation & Tropical Diseases

25 Years of Medical Experience

Nurse Kookkik

Registered Nurse

19 Years of Medical Experience

Dr. Kao

Health Care Management

General Practitioner

Dr. Patrick

Health Care Management

General Practitioner

Dr. Thet

Internal Medicine & Rehabilitation Medicine

9 Years of Medical Experience

The LUMA Asia Pass extends coverage to both inpatient and outpatient treatments across Asia for covered conditions. It's important to adhere to standard practices, and all costs must be reasonable. For information on necessary documents for claims, please consult the policy guidelines.

In case of Serious Injury or Illness requiring immediate treatment, and if local medical facilities are insufficient in the broader Asian region, our coverage includes emergency evacuation. The evacuation will be arranged to the nearest suitable facility using the most effective mode of transportation capable of providing necessary medical care. Please note that only the Insurer and/or the Assistance Company can coordinate the evacuation.

After an Emergency Evacuation, assistance with repatriation can be provided if necessary. Please note that the decision and coordination of repatriation are the exclusive responsibility of the Insurer and/or the Assistance Company.

This travel insurance policy extends coverage to include motorbike accidents for both riders and passengers in Asia. To qualify for this protection, individuals must wear a helmet, comply with local regulations, and hold the necessary license to operate or rent the motorbike.

Ensure your trip across Asia stays on course. With our Trip Cancellation coverage, you are protected against losing deposits or facing additional expenses due to unexpected events like illness, emergencies, or natural disasters. You can cancel or shorten your trip and get reimbursed for unused expenses. Coverage for this benefit starts from the policy issue date until the departure date specified in the itinerary.

Should your trip be cut short due to reasons such as illness, emergencies, or natural disasters, rest assured you'll be reimbursed for the unused portion of your travel expenses. Whether it involves returning home sooner or arranging alternative accommodations, our coverage provides peace of mind, allowing you to fully enjoy your travels across Asia without worry.

If your flight experiences delays due to factors like adverse weather, strikes, or technical issues outside your home country and beyond your control, this travel insurance provides coverage across Asia. You are entitled to compensation for every full 6-hour delay, up to the specified policy limit. To qualify, the delay must exceed 6 hours and not be due to failure to check in or reconfirm on time. Obtain official documentation from the airline detailing the cause, date, time, and duration of the delay. Please note that this coverage excludes issues existing at the policy’s commencement or problems caused by government authorities.

If your luggage is temporarily lost upon arrival in Asia for at least 6 hours, this travel insurance provides coverage for emergency purchases of essential toiletries and clothing. The delay should not result from customs or government officials, and you must submit documentation, including original purchase receipts.

This Travel Insurance across Asia offers compensation for loss, breakage, or damage caused directly by theft, robbery, burglary, accidents, or mishandling by carriers during the insured person’s journey. To qualify for coverage, the loss must be reported to local authorities or carriers within 24 hours. It’s important to note that this benefit does not cover loss or damage due to delay, confiscation, wear and tear, or loss of specific items like cash, electronics, fragile articles, and more. For comprehensive details and exclusions, please consult the policy.

Please note: The term “Asia” as mentioned on this page and travel insurance policy refers specifically to the countries explicitly listed and covered within the policy documentation.

LUMA Asia Pass Coverage

The policy covers medical expenses for sudden and unforeseeable injuries from accident and sickness (including COVID-19) during the travel to the country within the zone of coverage.

There is no direct billing in respect of medical expenses provided under this Policy unless the expenses are expected to exceed 1,000 USD and that the arrangement is coordinated by the Company or its designated assistance company.

If you would like to change the start and end dates of your LUMA Asia Pass policy, please contact our teams.

Please note: the former plan duration and the new revised plan duration should remain within the same range. If not, we invite you to cancel the existing policy and purchase a new one with the correct dates.

If you have purchased your policy but have not travelled yet you can make a request to change details on the Certificate of Insurance (COI).

Please contact our teams to do so.

A beneficiary is the person or entity you name in an insurance policy to receive the death benefit (example: wife, husband, father, mother, son or daughter).

Children aged at least 4 weeks are eligible to apply for LUMA Asia Pass.

Children under the age of 7 years must be accompanied by an adult who is also insured under the same Policy.

To submit a claim, please follow the link below. Please follow all instructions and submit all information and documents as indicated in the claims form.

For emergencies, please call Luma at +6624943600.

LUMA Asia Pass policy holders have up to 30 days after the expiry of their policy, to submit their claims. To claim under the “Personal Liability” section of the policy, the claims must be given within 15 days after the incident.

Both. Please inform on the below when sending the claim:

1. Account Holder Name :

2. Account Number :

3. Insured Address :

4. Telephone :

5. Bank Name and Branch:

6. Bank address :

7. SWIFT Code :

8. IBAN Code/ Routing Number (IBAN Code for European zone / Routing Number for American zone):

9. Currency :

To change of any of the following:

For travelers who have purchased a policy with LUMA Asia Pass and who have not travelled yet; changes on the Certificate of Insurance (COI) are free of charge.

For travelers who have purchased a policy with LUMA Asia Pass and who have not travelled yet; you can request to cancel your policy and ask for a refund.

Please also note: the cancellation must be based on a reasonable reason, prior to the start date of the policy.

Crafted and Serviced by LUMA

Our goal is to be your companion for all things travel and we strive to make insurance easy, accessible and ethical.

Insured by Baolong

With over three decades of expertise across a diverse range of insurance services, Baolong ensures your claims are covered.

Assistance by Europ Assistance

Europ Assistance is a leading assistance company with an international network ensuring a reliable support worldwide.

“LUMA Asia Pass” is the commercial name of the travel insurance policy insured by Bao Long Insurance Corporation, distributed globally by Luma International and serviced by Luma Care Co. Ltd.

Copyright © 2024 lumahealth.com. All Rights Reserved.