What is Personal Accident Travel Insurance?

Personal accident travel insurance is a benefit included in many travel insurance plans. It provides financial compensation in case of accidental death, permanent disability, or even temporary disability due to an accident while you’re on your trip.

What Does Personal Accident Travel Insurance Cover?

Personal accident insurance typically covers various benefits depending on the severity of the accident, such as:

- Accidental Death: If you suffer a fatal accident during your trip, the insurance pays a lump sum benefit to your designated beneficiary as outlined in the policy.

- Permanent Disability: In case of a permanent disability caused by an accident while traveling, the insurance might provide a benefit payout based on the policy coverage amount and the extent of the disability.

- Temporary Disability: Some plans offer coverage for medical expenses and lost income if you’re temporarily unable to work due to an accident during your trip.

Important Things to Consider:

- Coverage Limits: There are typically limits on the amount of money the insurance company will pay out for accidental death or permanent disability benefits. Understand your policy’s coverage limits to ensure they meet your needs.

- Activities: Certain high-risk activities like extreme sports might be excluded from coverage or require additional premiums. Review your policy details for activity exclusions.

- Pre-existing Conditions: Similar to medical expense insurance, pre-existing medical conditions might have limitations or exclusions in your coverage. Be sure to review your policy details carefully.

Remember: Always check your specific policy wording for any additional details, exclusions, or requirements regarding personal accident coverage.

What is Not Covered by Personal Accident Travel Insurance?

While personal accident insurance offers valuable protection, it’s important to understand its limitations:

- Non-accidental Events: If you fall ill or get injured due to illness or sickness, this wouldn’t be covered under personal accident insurance.

- Self-inflicted Injuries: Injuries sustained due to intentional self-harm or risky behavior are typically not covered.

- War and Terrorism: Accidents related to war, civil unrest, or terrorism might be excluded from coverage. Review your policy wording for specifics.

Do I Need Personal Accident Travel Insurance?

Here’s how to decide if personal accident insurance is right for you:

- Travel Activities: If you’re planning adventures or activities that carry a higher risk of accidents, this coverage can provide peace of mind.

- Financial Protection: Consider your financial situation and the potential impact of an accident on your income or ability to cover medical expenses abroad.

- Age and Health: Travelers with pre-existing medical conditions or those over a certain age might find this coverage particularly valuable.

How Much Does Personal Accident Travel Insurance Cost?

The cost can vary depending on several factors, including your age, destination, trip duration, and the level of coverage you choose. Be sure to get a quote from each travel insurance company to get an accurate feel for how much it would cost specifically for you.

As an example: for LUMA Asia Pass’s Personal Liability insurance costs typically range from $50 to $150 for basic coverage for a one-week trip to Vietnam on the most basic plan. However this would come with other benefits as well so the cost of the personal liability would be even less!

How Much Coverage Do I Need?

The amount of coverage you need depends on your circumstances. Factors like your age, health, trip duration, and planned activities can influence your decision. Generally, it’s wise to choose a plan with coverage limits that can adequately address potential financial burdens in case of an accident. It is best to get the highest coverage if you are going to remote place in the country.

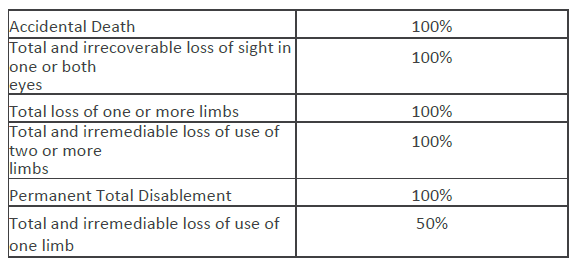

Here is an example from LUMA Asia Pass, here is a table showcasing the covered reason and percentage of coverage the policyholder would receive up to their coverage limit.

How Does Personal Accident Travel Insurance Work in a Real-life Example?

Imagine you break your leg while walking down some steep temple stairs during your Chang Mai adventures in Thailand. Your personal accident insurance, with permanent disability coverage, can provide a financial benefit to help cover the expenses associated with the accident.

Personal accident travel insurance offers a financial safety net in case of unexpected accidents. By understanding what it covers and how it works, you can choose the right plan for a worry-free travel experience